While 2021 saw lateral moves more than double year-over-year, fueled by six-figure bonuses for associates and law firms chasing rainmakers, a different class of lawyers gained the upper hand during 2022.

Mid-level partners.

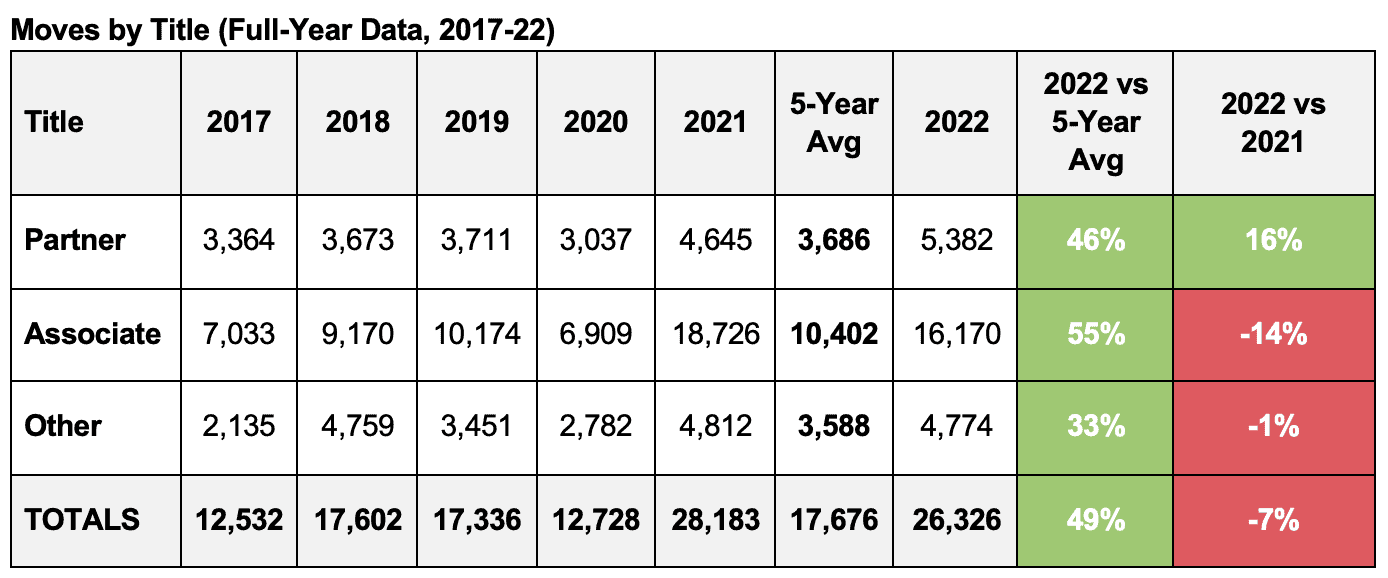

While 2022 wasn’t as spectacular as 2021 in terms of the sheer number of moves across the profession, it was another great year for partners. Data tracked by Decipher Investigative Intelligence shows moves across all titles were up nearly 50 percent in 2022 compared to the previous five-year average, but only partner-level moves saw a year-over-year increase.

Of course, it’s not a surprise associate hiring couldn’t maintain a skyrocketing year-over-year pace after associate moves increased by 171 percent in 2021.

Overall, partner mobility is at an all-time high and appears to represent the “New Normal.” In 2022, partner moves increased by 16 percent vs. 2021 and by 46 percent over the previous five-year average. And mid-level partners were a big reason for that continued increase.

When partner moves increased 52.9 percent from 2020 to 2021, firms were offering a 72 percent Compensation-to-Book of Business ratio to high-level partner candidates. Comp-to-Book offers to that group dropped to 64 percent in 2022, while mid-level partner candidates saw their Comp-to-Book offers increase from 64 to 72 percent in 2022.

Decipher extensively compiles data on lateral moves throughout the AmLaw 100, 200 and beyond. Beyond experience level, here are insights into practice areas and locations for partner-level moves in 2022 to help law firm leaders to understand where they might (and might not) have leverage when making hires.

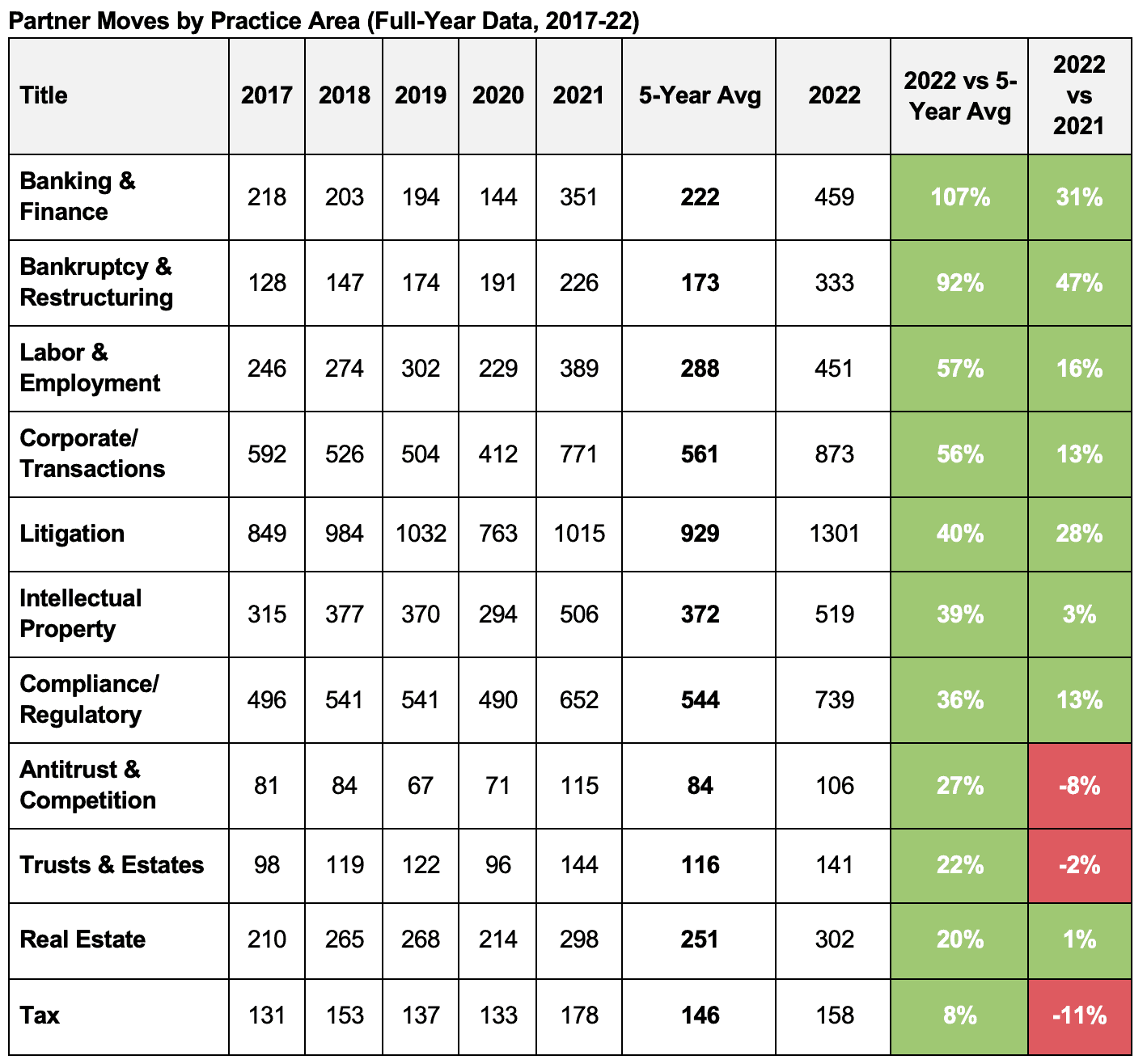

Practice areas

The top five practice areas where partners were in most demand last year also mirrored the five-year trend:

- Banking & Finance, up 107 percent over the five-year average;

- Bankruptcy & Restructuring, up 92 percent;

- Labor & Employment, up 57 percent;

- Corporate/Transactions, up 56 percent;

- Litigation, up 40 percent.

But when looking at year-over-year moves, the order of the top five is different—and reveals that law firm hiring leaders were thinking a recession is on the horizon.

While litigation and corporate are traditionally the two biggest practice areas by volume for lateral moves, they were outpaced by Bankruptcy & Restructuring (up 47 percent) and Banking & Finance (up 31 percent) in year-over-year moves in 2022. Firms were placing bets on the potential for a recession, making moves in line with interest rates rising.

On the topic of interest rates, Real Estate was one of the few groups that saw moves slow down. That practice area was nearly flat with a 1 percent increase in year-over-year moves. Three areas saw declines in year-over-year moves:

- Tax, down 11 percent from 2021

- Antitrust & Competition, down 8 percent

- Trusts & Estates, down 2 percent

Intellectual property is another area that businesses look to protect during a financial downturn, but while IP partner attorney moves were up 39 percent compared to the previous five-year average, they only increased 3 percent year-over-year.

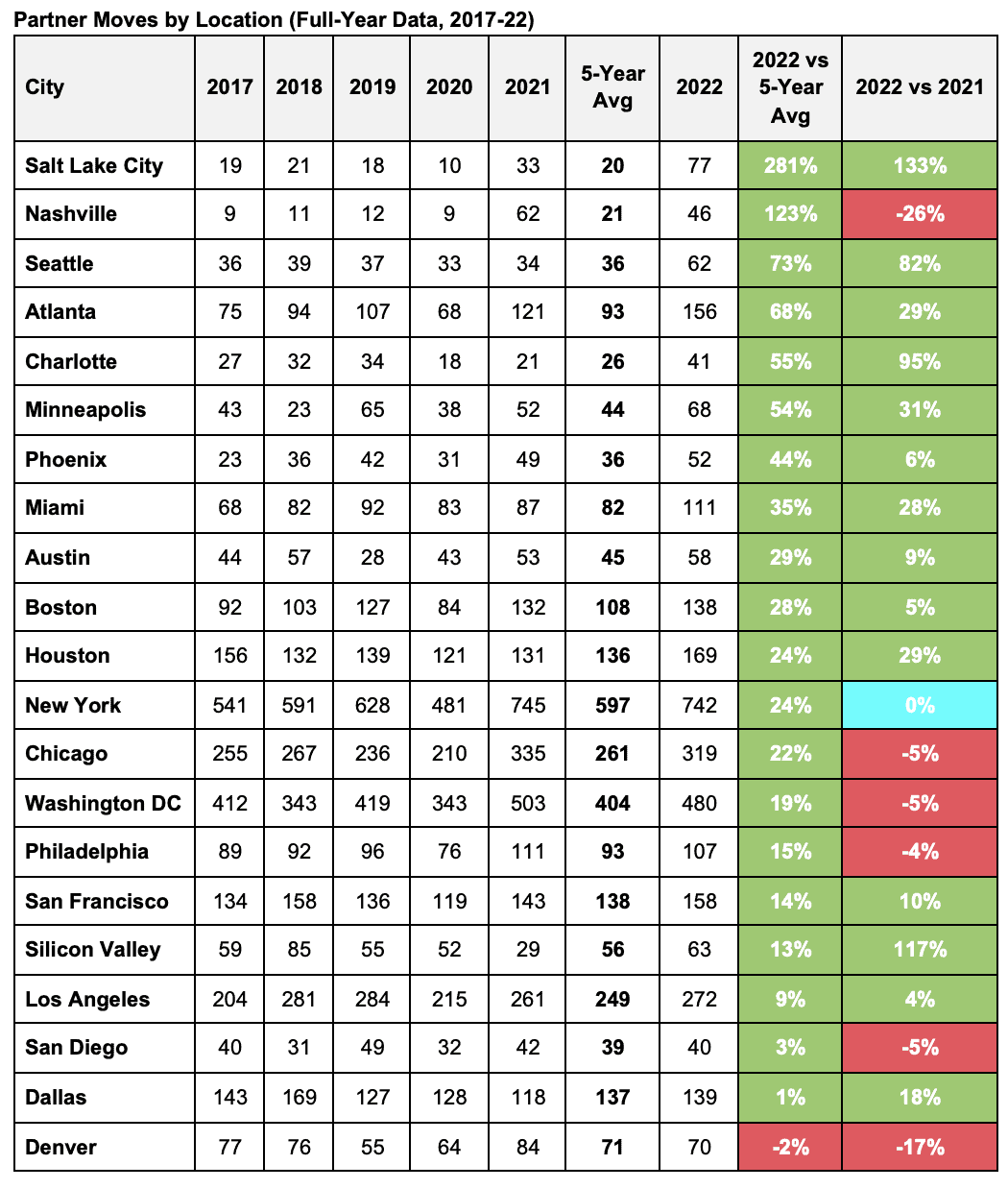

Locations

Among larger markets, those with an average of more than 50 partner moves over the previous five years (2017-21), five saw more than 18 percent year-over-year growth:

- Silicon Valley, 117 percent increase

- Atlanta, 29 percent

- Houston, 29 percent

- Miami, 28 percent

- Dallas, 18 percent

All but one of the markets tracked by Decipher saw an increase in lateral partner moves compared to the previous five-year average. Atlanta led the way among large markets with a 68 percent increase, while Denver was the only market that saw a decrease in lateral partner moves when compared to the previous year and the five-year average.

Several large markets were either flat or saw a year-over-year decrease in partner moves:

- Denver, down 17 percent from 2021

- Chicago, down 5 percent

- Washington, D.C., down 5 percent

- Philadelphia, down 4 percent

- New York, 0 percent increase

Among these five cities, however, only Denver saw a decrease in lateral partner moves compared to its previous five-year average (2 percent). Lateral partner hires in New York increased 24 percent compared to the five-year average; Chicago was up 22 percent; Washington, D.C. up 19 percent; and Philadelphia increased by 15 percent.

As the data shows, the market remains hot for many types of lateral partners; you are likely to pay a premium for lawyers in certain practice areas and locations. (Particularly for talent with financial acumen, talent in Silicon Valley, or the dreaded combination thereof.)

At the same time, lateral partner failure rates remain high: 48 percent leave their new firm within five years and 62 percent fail to bring their promised book of business. Furthermore, the cost of replacing a failed lateral partner can approach or exceed seven figures.

That’s why it’s wise to protect your investment (and your firm’s culture) with due diligence. Decipher provides actionable intelligence about lateral candidates to law firm hiring leaders that allows them to make informed decisions. To learn more about Decipher’s strategies and solutions, contact us today.