Lateral lawyer moves in Q3 2023 once again lagged behind the previous year’s pace, but as we’re reported before, that’s only because 2022 was a unicorn, a record-breaking hiring year.

Q3 partner moves were down 29 percent compared to Q3 a year ago, but there were still 15 percent more partner moves in Q3 vs. the previous six-year average and 32 percent more compared to the average of the last three pre-pandemic years, signaling a continuing healthy and robust lateral moves environment. Partner moves by location and practice areas also significantly outperformed pre-pandemic averages, in many cases by double-digit margins.

On the associate side, a headcount rebalancing is still in progress, with firms dealing with fallout from trends coming out of the post-pandemic hiring explosion. Even though associate moves in Q3 were down 32 percent from last year and 5 percent compared to the previous 6-year average, associate hiring is closer to pre-pandemic levels than what we’ve seen the past two years.

Here are more insights for law firm leaders from Decipher Investigative Intelligence’s data on lateral partner and associate moves in Q3.

Partners

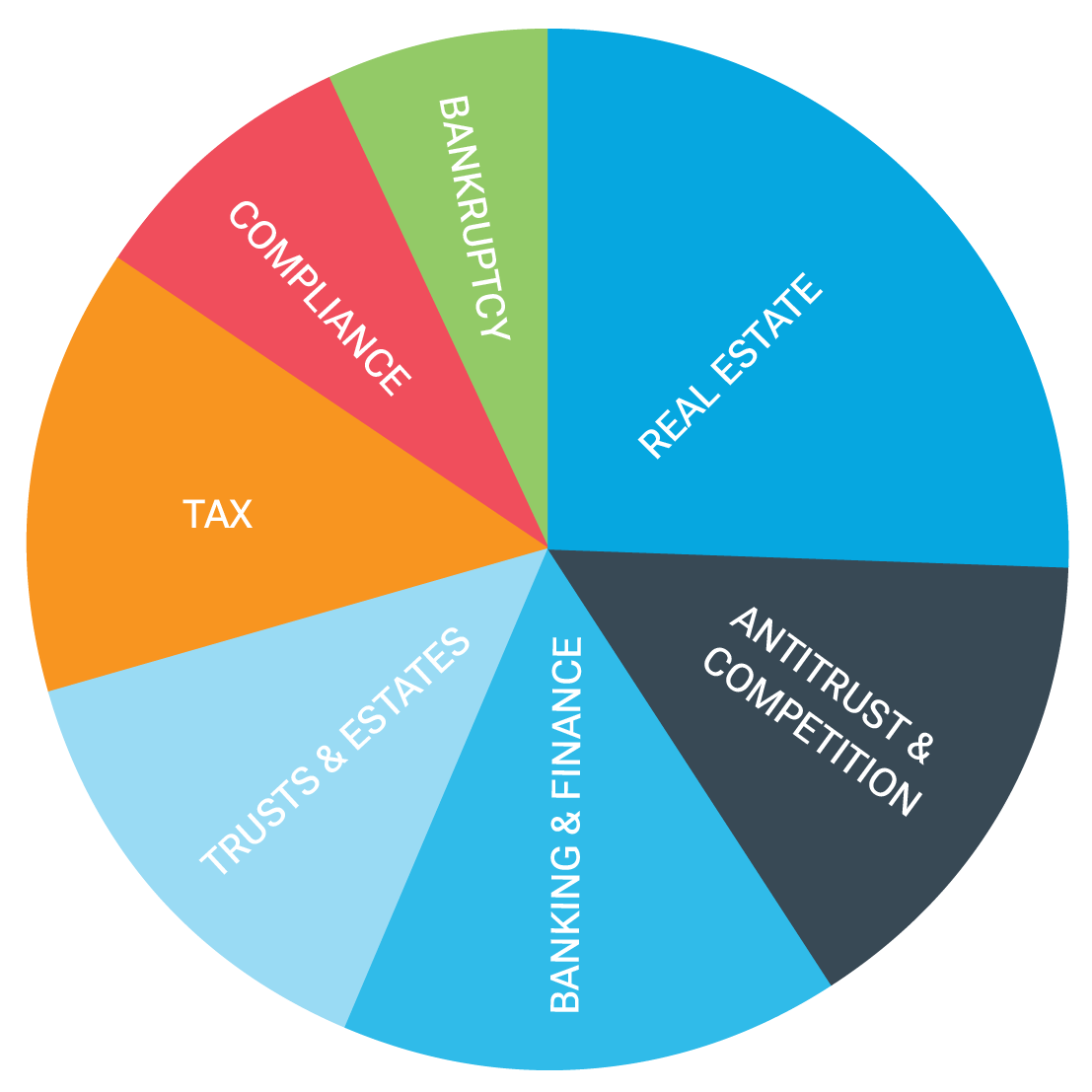

While lateral partner moves decreased across the board compared to Q3 of last year, most practices are still seeing significant increases in lateral partner moves over the previous six-year average, with the exception of Corporate (down 13 percent), as demand for transactions has decreased over the last 12 months. Leading the way: Trusts & Estates (up 86 percent), Real Estate (47), Tax (32), Banking & Finance (29), and Bankruptcy (29).

Looking at year-to-date moves by practice area, the market is still extremely active compared to the pre-pandemic environment. Seven of the 11 practice areas tracked are seeing greater than 33 percent increases in lateral partner hiring compared to the 2017-2019 average.

YTD Lateral Partner Moves by Practice Area 2023 vs. 2017-19 Avg.

Major Market Moves

- All markets were down compared to last year’s Q3 lateral partner moves, with nine (75 percent) experiencing more than a 30 percent reduction. Only Los Angeles, likely because of litigation and labor/employment-related work, and Philadelphia outperformed the 6-year average in Q3.

- However, when factoring out 2020 (pandemic) and 2021-22 (record years), 75 percent of major markets actually experienced an increase in Q3 lateral partner moves over pre-pandemic averages (2017-2019), led by Los Angeles, Boston, New York, and Atlanta (all 20-plus percent increases).

- Miami (crypto/technology), Houston (energy sector), and Silicon Valley (technology/life sciences-heavy) saw decreases in Q3 hiring compared to pre-pandemic averages, with Silicon Valley experiencing an almost 60 percent reduction in partner moves.

- When looking at year-to-date lateral partner hires for 2023, 10 of 21 markets overall have seen a 25 percent increase over pre-pandemic averages. Texas is one of the few markets to see partner moves decrease; however, the state was one of the fastest-growing markets before the pandemic.

Secondary Markets

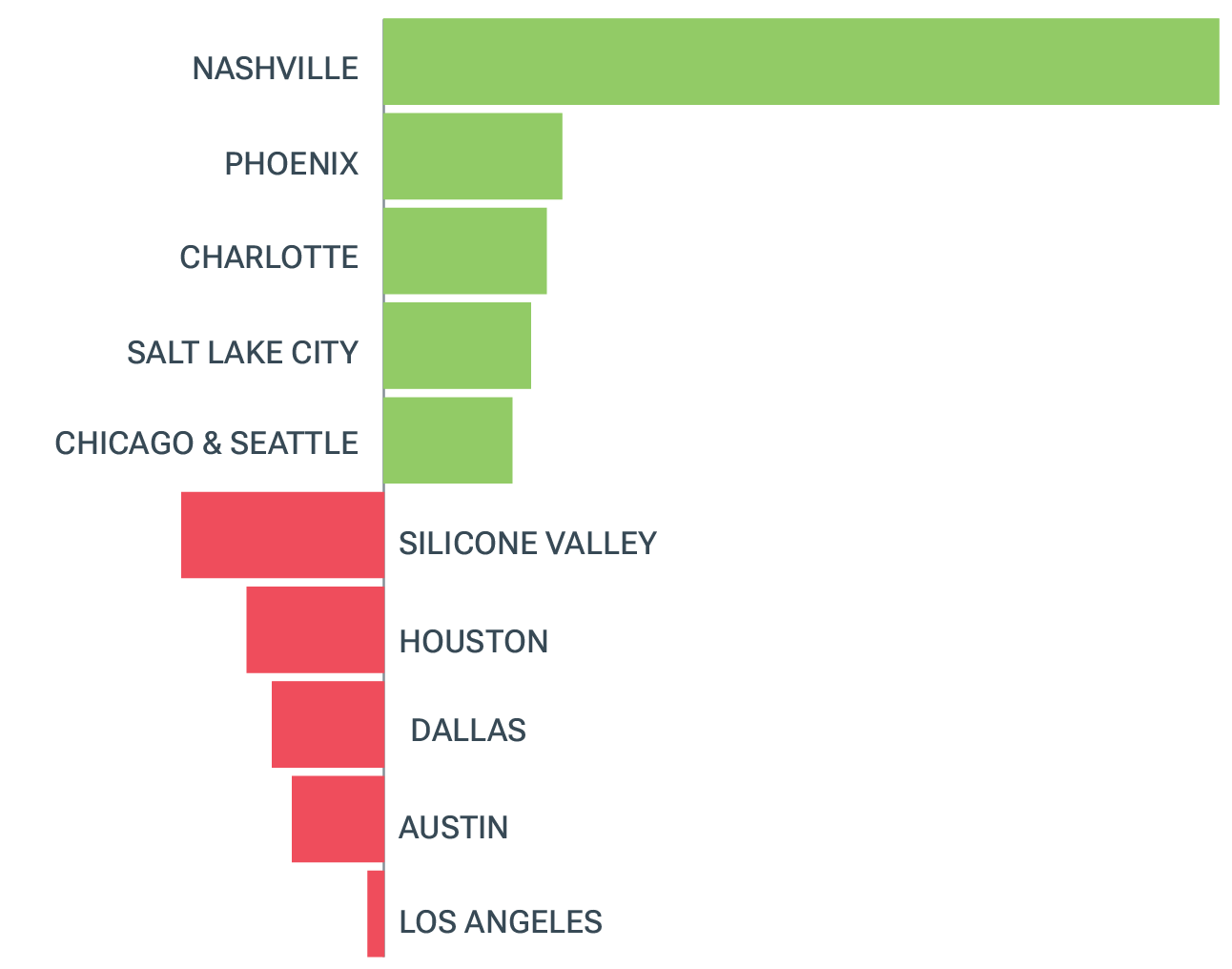

- Continuing the year-to-year trend, all markets were down compared to Q3 a year ago, and two-thirds saw double-digit decreases in lateral partner moves compared to the previous-6 year average. Phoenix, Seattle, and Minneapolis bucked this trend, with Phoenix experiencing a 35 percent increase over the previous 6-year average. Phoenix’s population has been growing rapidly over the last decade, and law firm expansion into this market is a natural progression of this population trend.

- Charlotte (banking), Austin (technology), Salt Lake City (technology/software) and Nashville (healthcare) all had practice areas that experienced a significant hiring slowdown and saw a 30-plus percent decrease in lateral partner moves compared to the previous 6-year average. Only Denver, San Diego, and Charlotte underperformed vs. the pre-pandemic average.

Lateral Partner Moves by Location YTD (2023 vs. 2017-19 Avg.)

Associates

Consistent with most other Q3 moves data, we’re seeing a significant reduction in year-to-year lateral associate moves. Associate hiring is off almost half of last year’s pace and down 20 percent compared to the previous six-year average. But 2023 is still faring better than 2017, 2018, and 2020. The previous two years have skewed the data so much, that even a better than average year would still result in decreased associate moves numbers.

Major Market Moves

- Every market experienced at least a 10 percent reduction in associate moves over last year’s Q3.

- Nearly half of these markets outperformed the previous six-year average, led by Philadelphia (up 14 percent), Silicon Valley (8), Washington, D.C. (6), New York (4) and Los Angeles (3).

Secondary Markets

- Secondary markets aren’t faring as well as major markets. Only Nashville has experienced an increase in moves compared to the previous 6-year average, with every other market witnessing at least a 10 percent reduction in associate moves against that average.

- The trend is even worse when looking at Q3 2023 compared to Q3 2022, with the overwhelming majority of secondary markets (92%) seeing at least a 30% decrease in YTY Q3 associate moves.