Throughout 2023, Decipher Investigative Intelligence started to notice a “new normal” appear in the lateral hiring data we’ve tracked over the last six years. The drop in hiring from record levels during 2021 and 2022 finally reached a plateau last year, yet hiring remained 30 percent higher than pre-pandemic averages. Looking ahead, our 2024 projections suggest more consistent trends in lateral hiring compared to the roller coaster of the last three years.

The data in this article is a snapshot of the full picture that’s available in our soon-to-be-released annual report, in which we champion a new and innovative approach for how lateral moves are measured, evaluated, and ultimately deployed.

Until then, let’s dive into some of the 2023 data, and our 2024 predictions.

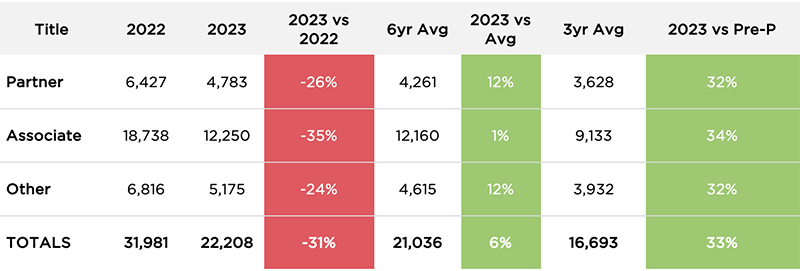

Partner moves in 2023 were down 26 percent year-over-year but up 12 percent compared to the previous six-year average (2017-2022). Associate moves followed a similar path: down 35 percent from 2022 and virtually flat (up 1 percent) compared to the six-year average.

Moves by Title (2017-2023)

But the real story emerges in comparing moves in 2023—and our predicted 2024 numbers—versus the three-year pre-pandemic average of 2017-2019. Across the board, moves in 2023 were at least 32 percent higher than the years leading up to the pandemic, and 2024 is expected to see only a slight decline, resulting in about 20 percent more hiring in 2024 versus the last three pre-pandemic years (2017-2019).

Other insights from our 2023 data:

Moves by Position

As the table shows, while the number of total moves is stabilizing, there is a difference between the partner and associate hiring environment. In an ongoing trend, firms are rebalancing their associate headcounts, which explains why partner hiring outpaced associate hiring in 2023 versus 2022 and why we expect there to be a slight decrease in associate hiring this year.

Why? Law firms view partner hirings as the primary and fastest way to grow revenue, while many firms are starting to move on from associates hired during the 2021-2022 “gold rush” where increased compensation packages led to bloated operational costs. Firms can either hire a replacement level candidate for 40 to 50 percent less or get by without filling the role.

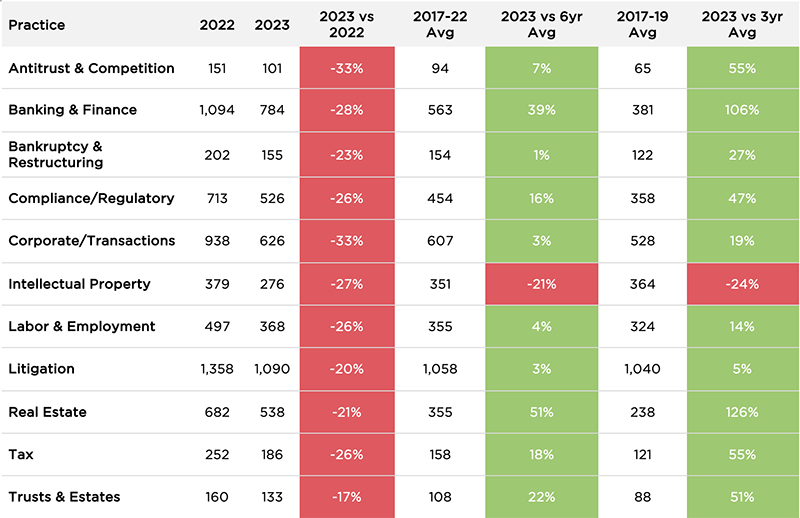

Moves by Practice Area

Just like overall partner moves, year-over-year comparisons don’t tell the whole story of hiring by practice area in 2023. Partner hires across all practice areas dropped by 17 to 33 percent year over year, but hiring increased in every practice area but one—Intellectual Property—when compared to the three- and six-year averages.

The hottest practice areas for partner hires compared to the pre-pandemic years? Real Estate, which saw 126 percent more hires in 2023 compared to the last three pre-pandemic years; Banking & Finance (up 106 percent); and Antitrust & Competition and Tax (both up 55 percent).

Partner Moves by Practice Area

Associate moves by practice area mirrored partners with a few exceptions. Like partners, associate hiring dropped in every practice area in 2023 compared to the previous year, but by larger percentages—between 26 and 41 percent. And while, like partners, associate hiring increased in every practice area but Intellectual Property when compared to the three-year pre-pandemic average, three additional practice areas (Bankruptcy & Restructuring, Corporate/Transactions, and Litigation) hired fewer associates in 2023 compared to the six-year average and one (Trusts & Estates) was flat.

Moves by Location

As expected by the overall and practice area data for partner moves, all markets were down in 2023 compared to 2022. Four major markets and five secondary markets outperformed the six-year average:

Major markets for partner mobility:

Philadelphia +11%

Chicago +8%

New York +3%

Boston +1%

Secondary markets for partner mobility:

Charlotte +37%

Nashville +34%

Phoenix +23%

San Diego +17%

Seattle +16%

The biggest drops in partner hiring were seen in energy-sector-heavy Houston (down 46 percent vs. 2022 and 17 percent against the six-year average) and Salt Lake City (technology/software), which saw a 77 percent year-over-year drop in partner hiring and 30 percent decrease compared to the six-year average. Partner hires in Silicon Valley dropped 34 percent year-over-year and 30 percent compared to the six-year average.

Keeping with the trend, associates fared worse than partners when looking at moves by location. Like partner moves, all markets saw year-over-year drops in associate moves but only one major market (Houston, up 7 percent) and three secondary markets (Nashville, up 23 percent; San Diego, up 5 percent; and Salt Lake City, up 3 percent) saw increased associate hiring in 2023 compared to the six-year average.

Markets with the biggest associate hiring declines year-over-year: Salt Lake City (down 58 percent) Seattle (down 54 percent), Charlotte (down 46 percent), and Atlanta (down 45 percent).

What This Means for You

Again, we anticipate another robust year for lateral partner hiring in 2024, with activity up about 20 percent over the last three pre-pandemic years.

If trends hold true, law firms seeking to acquire talent in hot practice areas (Real Estate, Banking & Finance, Antitrust & Competition and Tax) and attractive regions (Philadelphia, Charlotte, Nashville and Phoenix) must understand they are operating in a seller’s market.

Data is critical at all stages of the lateral recruitment pipeline: to identify strategic candidates, to assess candidates’ books of business and cultural compatibility, and finally, to provide realistic benchmarks for compensation.

Is your firm ready for a more purposeful, profitable growth strategy? Contact us today.